Tavid uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Czechs Trigger Long-Awaited Koruna Float Without Swiss Shock

- Board voted to remove limit on koruna after more than 3 years

- Bets on currency gains lured record amounts of foreign capital

By signaling that its currency cap would end, the Czech central bank’s announcement that it would no longer keep the koruna artificially weak against the euro avoided the Swiss-like market shock and quick gains some investors anticipated.

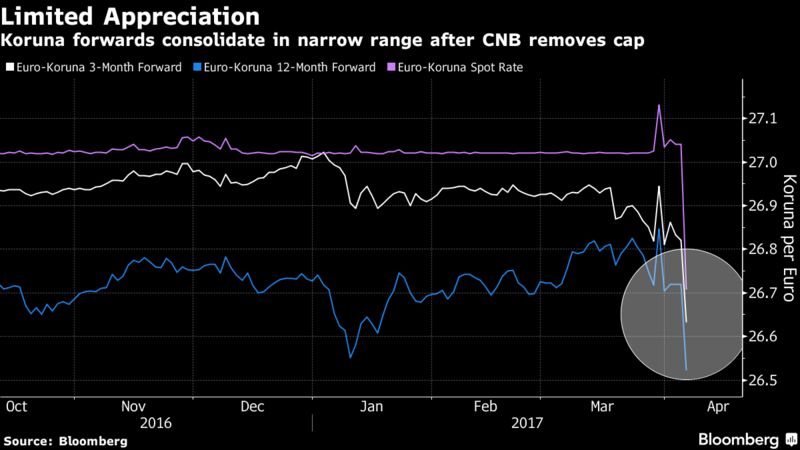

With resurgent inflation rendering the policy obsolete, policy makers scrapped the cap that has prevented the koruna from appreciating past 27 to the euro since 2013. By 5:30 p.m. on Thursday in Prague, it was trading near its strongest of the day, 26.57, up 1.8 percent.

The gain — unlike the one-day jump of 41 percent in the Swiss franc when a similar cap was lifted in 2015 — proved an anti-climax for investors who’d piled into Czech assets in the hope of making a risk-free profit. The Czech central bank had warned speculators they may struggle to find counterparties to cash out of their positions. It said it has now returned to a managed-float regime and it will intervene at any time it deems necessary.

“If you want to drop a currency peg, then the CNB can show you how to do it,” said Kathleen Brooks, head of research at brokerage firm City Index in London. “Dismantling a long-held currency regime doesn’t need to be as volatile or panic-stricken as the Swiss peg debacle back in 2015.”

The yield on Czech two-year bonds jumped 27 basis points to minus 0.11 percent. Eastern European currencies edged higher, with the Polish zloty reversing a loss of as much as 0.2 percent against the euro and the Hungarian forint rising 0.1 percent.

Governor Jiri Rusnok said the central bank, which originally imposed the cap to avert deflation, would now tolerate volatility. By scrapping the cap, the bank made good on its word after insisting that it would eventually abandon the monetary easing tool and return to conventional policy. The move came almost a week after its official commitment to keep the limit in place expired.

Policy makers will have “pain thresholds for both appreciation and depreciation” that are very wide and unlikely to be reached by the currency in the near future, Rusnok said. “I definitely don’t expect us to be present in the market” in the immediate future.

Jiri Rusnok on April 6.

“We have to be patient, we shouldn’t be swayed by what’s happening in the first hours and days after the exit,” he told reporters in Prague. “It’s a bit like when the patient is waking up from anesthesia. He may feel not so well for some time, but that doesn’t mean the operation wasn’t successful.”

By allowing the koruna to trade freely again, the Czech central bank is signaling confidence the economy can withstand a stronger currency that will make exports less competitive while undercutting import-driven prices. Annual price growth now exceeds 2 percent and gross domestic product is forecast to expand at least 2.6 percent in the coming three years, according to economists surveyed by Bloomberg.

Analysts differed on their estimates of where the bank’s limits may reside. Pavel Sobisek, chief economist at Czech unit of UniCredit SpA, said policy makers would probably let the currency float between 25 and 28 against the euro, while Nomura Holding Inc’s Peter Attard Montalto said it could be between 25 and 27.5.

Read more about what might happen now that the koruna cap has dropped

“Completely unlike to the euro/Swiss removal, which was entirely unexpected and put the market off guard, this is a much more telegraphed event,” said Manik Narain, an economist at UBS AG, who said he saw the koruna 6 percent undervalued. “That is preventing the cross moving more aggressively lower.”

The latest official data show that the central bank bought 47.8 billion euros ($51.3 billion) in the four years through January to prevent the koruna from gaining beyond the limit. Adjusted for natural inflows seen in the balance of payments, the overall speculative position was about 50 billion euros to 60 billion euros as of March, according to estimates by Jan Bures, an analyst at the Czech unit of KBC Groep NV. ING Groep NV puts the intervention volume at about 36 billion euros so far this year.

But at least some of the speculative capital fled the koruna after the central bank stopped providing guidance at the end of March on the likely timing of the exit. The koruna has since shown volatility not seen in years.

“The initial gains are less than investors were probably looking for,” said Paul McNamara, a money manager who helps oversee $6.3 billion at GAM UK Ltd. “There’s potential for this to go wrong, as the long-koruna position is huge and the door too small. That’s exactly why we stayed away from this trade.”

https://www.bloomberg.com/news/articles/2017-04-06/czech-central-bank-ends-currency-cap-to-let-koruna-float-again