Tavid uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

UBS Wealth Recommends Buying Gold Near $1,200 for Insurance

Ranjeetha Pakiam

Bloomberg, 04. July 2017

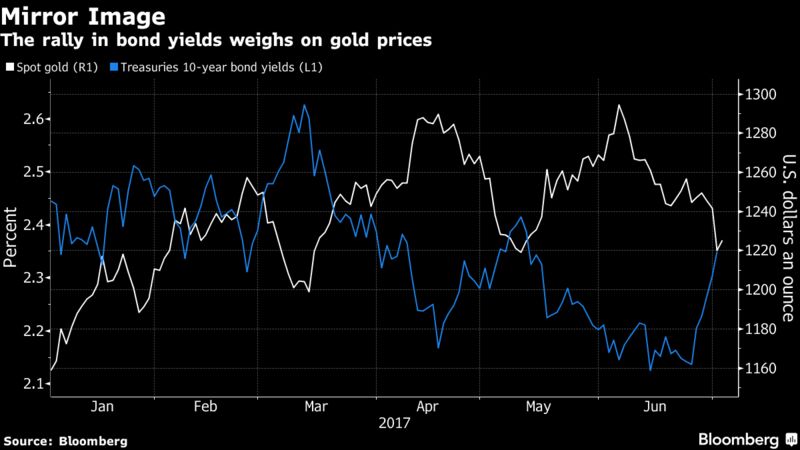

Gold will probably trade in a range of $1,200 to $1,300 an ounce in the short-term as the metal tracks U.S. real interest rates, according to UBS Group AG’s wealth management unit.

“We’re not saying we have a bullish bias; we’re not saying we have a bearish bias,” Wayne Gordon, executive director for commodities and foreign exchange, said in an interview on Tuesday. “We’re saying that tactically, people should be buying it somewhere near $1,200 and selling it again somewhere near $1,300, and it’s because we have a view that real rates go sideways. So the pickup in nominal rates will be equally matched by the pickup in inflation.”

Bullion climbed almost 9 percent in the first quarter, buoyed by worries over Donald Trump’s presidency and geopolitical risks. Prices have since fallen and posted their first monthly decline this year in June. On Monday, the metal fell the most since November as equities and bond yields rallied, before North Korea’s launch of what the U.S. said was an intercontinental ballistic missile sparked a small rebound. The price was at $1,222.05 on Wednesday.

If U.S. unemployment keeps falling, and the Federal Reserve keeps raising interest rates no matter what the inflation data show, that will be negative for gold in the short term, Gordon said. Still, solid demand this year and weaker output, coupled with a lower dollar, are positive for prices, he said. If equity valuations start to drop, investors could turn to gold too, he added.

Gold could also act as insurance if the labor market doesn’t show further improvement in the U.S. and inflation doesn’t pick up, which would make the Fed pause on its tightening path, or if global growth slows, said Gordon. “We like the insurance qualities for gold just from an unknown perspective at these sorts of levels,” Gordon said.

Bullion rose as much as 0.7 percent in two days after North Korea’s rocket launch revived geopolitical concerns. U.S. Secretary of State Rex Tillerson called the act a “new escalation of the threat” and the United Nations Security Council plans a closed session later Wednesday after a U.S. request.

Gold will probably range from $1,150 to $1,350 in the second half, depending on how global equity markets perform, whether Trump can implement his agenda and the strength of the dollar, Robin Tsui, an exchange-traded fund gold specialist with State Street Global Advisors, said in Hong Kong Tuesday.

Investor holdings in the SPDR Gold Trust, the biggest ETF backed by bullion, have shrunk to 846.29 metric tons, the lowest level in almost three months.