Tavid uses cookies to ensure website functionality and improve your user experience. Collecting data from cookies helps us provide the best experience for you, keeps your account secure and allows us to personalise advert content. You can find out more in our cookie policy.

Please select what cookies you allow us to use

Cookies are small files of letters and digits downloaded and saved on your computer or another device (for instance, a mobile phone, a tablet) and saved in your browser while you visit a website. They can be used to track the pages you visit on the website, save the information you enter or remember your preferences such as language settings as long as you’re browsing the website.

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| tavex_cookie_consent | Stores cookie consent options selected | 60 weeks |

| tavex_customer | Tavex customer ID | 30 days |

| wp-wpml_current_language | Stores selected language | 1 day |

| AWSALB | AWS ALB sticky session cookie | 6 days |

| AWSALBCORS | AWS ALB sticky session cookie | 6 days |

| NO_CACHE | Used to disable page caching | 1 day |

| PHPSESSID | Identifier for PHP session | Session |

| latest_news | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| latest_news_flash | Helps to keep notifications relevant by storing the latest news shown | 29 days |

| tavex_recently_viewed_products | List of recently viewed products | 1 day |

| tavex_compare_amount | Number of items in product comparison view | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| chart-widget-tab-*-*-* | Remembers last chart options (i.e currency, time period, etc) | 29 days |

| archive_layout | Stores selected product layout on category pages | 1 day |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| cartstack.com-* | Used for tracking abandoned shopping carts | 1 year |

| _omappvp | Used by OptinMonster for determining new vs. returning visitors. Expires in 11 years | 11 years |

| _omappvs | Used by OptinMonster for determining when a new visitor becomes a returning visitor | Session |

| om* | Used by OptinMonster to track interactions with campaigns | Persistent |

| Cookie name | Cookie description | Cookie duration |

|---|---|---|

| _ga | Used to distinguish users | 2 years |

| _gid | Used to distinguish users | 24 hours |

| _ga_* | Used to persist session state | 2 years |

| _gac_* | Contains campaign related information | 90 days |

| _gat_gtag_* | Used to throttle request rate | 1 minute |

| _fbc | Facebook advertisement cookie | 2 years |

| _fbp | Facebook cookie for distinguishing unique users | 2 years |

Visual Capitalist: How Every Asset Class, Currency, and Sector Performed in 2018

JEFF DESJARDINS on January 4, 2019

We’re only a few days into 2019, but it appears markets have picked up exactly where they left off.

There is growing uncertainty and volatility almost everywhere, and individual events are starting to become catalysts for sell-offs or rallies. Whether it’s Apple’s recent profit warning or Fed chair Jerome Powell saying that he is “listening closely”to the markets, investors are taking cues from current events to figure out where the herd is grazing.

It’s hard to say where markets will head in 2019 – but before we get into the nitty-gritty of a new year, it’s worth taking one final look back at 2018 to see how it impacted investors.

HOW MARKETS DID IN 2018

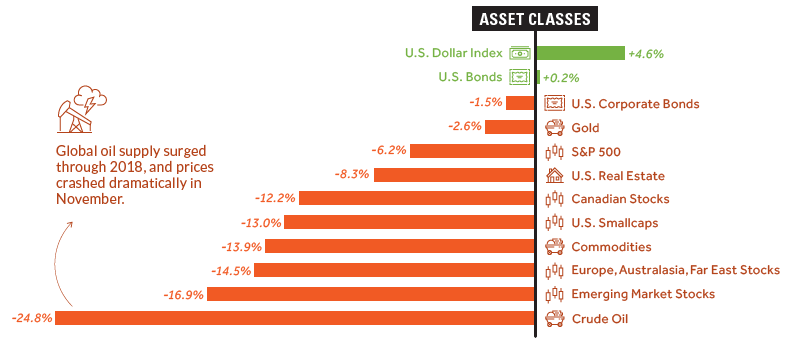

We’ll start with broad asset classes, including stocks, bonds, commodities, and cash:

Note: Figures for equity markets are not including dividends

As you can see, it’s mostly a sea of red.

Cash turned out to be best option for the year, and several asset classes were crushed over the course of 2018, including crude oil and nearly all stocks. Despite this, large cap U.S. stocks (S&P 500) had no issues in outperforming equity alternatives, like smallcap stocks, foreign stocks, or emerging markets.

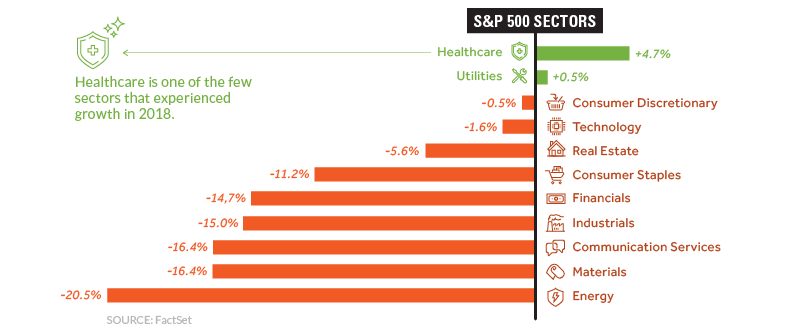

Breaking down the S&P 500 further into its sectors, it’s clear that nearly every industry struggled simultaneously.

Energy (-20.5%) and Materials (-16.4%) sectors were the hardest hit, and even the Technology sector eventually capitulated by the end of the year. Amazingly, Apple was considered a $1 trillion company in August, but today the tech giant’s market capitalization has already dropped down to a measly $700 billion.

The one exception to the general trend in S&P 500 stocks was Healthcare, which posted 4.7% returns over the course of 2018. Companies like Merck, Eli Lilly, and Pfizer all saw their stocks grow by double-digits, and it’s possible the sector could stay strong in 2019 as the world continues to age.

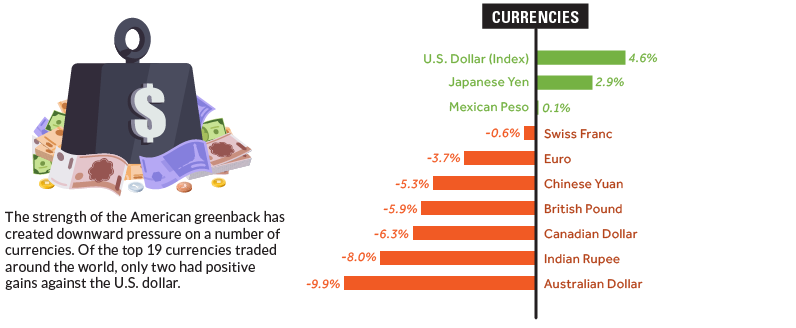

Lastly, here’s how major currency markets fared.

The U.S. dollar was the strongest major currency, and the Japanese yen had an impressive year as well. The Aussie dollar was routed, and now sits at 10-year lows.

WINNERS AND LOSERS

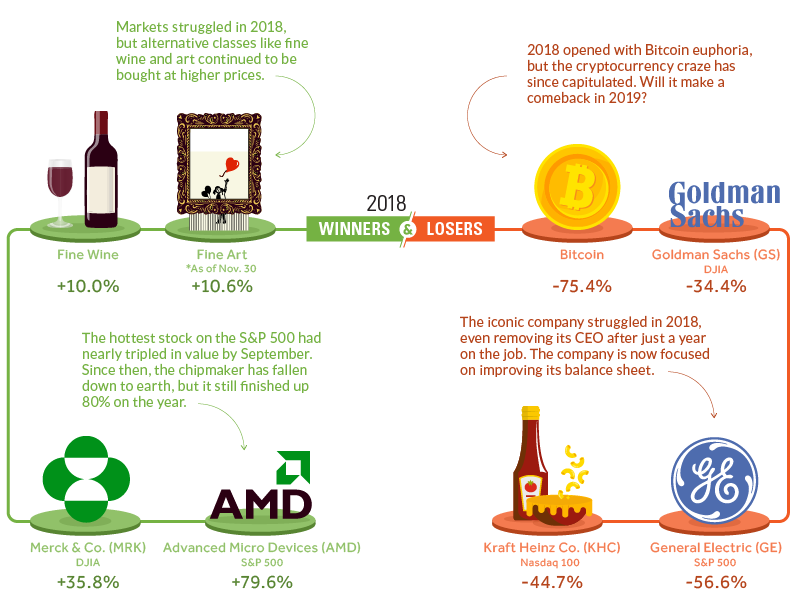

Lastly, here’s an ad hoc list of some of the biggest winners and losers in 2018 – it includes some of the stocks and assets that saw notable gains or declines over the course of the year:

Interestingly, it was the finer things in life that outperformed most major asset classes. Both fine wine and fine art gained close to 10%, leaving most other indices behind in the dust.

AMD had a roller coaster year, finishing up nearly 80% as the biggest winner on the S&P 500. That said, owners of AMD stock may see things differently: the stock had actually tripled by September, and has fallen precipitously ever since.

Given the above recap, what are you investing in for 2019?

Source: https://www.visualcapitalist.com/how-every-asset-class-currency-and-sector-performed-in-2018/